When apartment communities evaluate new amenities, few generate clearer operational and financial returns than automated package systems. Between time saved and improvement to operational efficiency it’s no wonder that properties see significant ROI on smart lockers.

Below is a simple breakdown of how to evaluate the return on investment for smart lockers in today’s multifamily environment.

Why Does ROI on Smart Lockers Matter for Apartment Owners?

Smart lockers are no longer a luxury feature. With online shopping continuing to grow and last-mile carriers delivering more frequently than ever, unmanaged package volume can strain labor budgets, reduce resident satisfaction, and expose communities to operational risk.

Many properties face consistent bottlenecks and rising staff workload, and these challenges are outlined in resources like the last-mile delivery challenges for property managers.

For owners responsible for NOI performance, the ROI conversation matters because manual package handling is expensive, time-consuming, and scales poorly as delivery volume increases.

How Do You Calculate the Cost of Managing Packages Manually?

A strong ROI analysis begins with two core inputs:

- Package volume: From our analytics, on average communities receive 60 packages per 100 units per day.

- Staff time: Furthermore, we’ve found that teams spend roughly 5 minutes per package on intake, notifications, storage, and retrieval. This doesn’t even include fielding the “where’s my package?” emails and complaints from residents.

Using these averages, a 300-unit community receives approximately 180 packages per day.

At 5 minutes per package, that equals:

- 900 minutes (15 hours) of staff time per day

- Roughly 75 hours per week

- At an average staff wage of $20/hour, that is $1,500 per week, or over $78,000 per year dedicated solely to package handling

This does not include overtime, turnover, inefficiencies, or the broader operational opportunity cost of pulling leasing teams away from revenue-producing tasks.

How Do Smart Lockers Reverse These Costs?

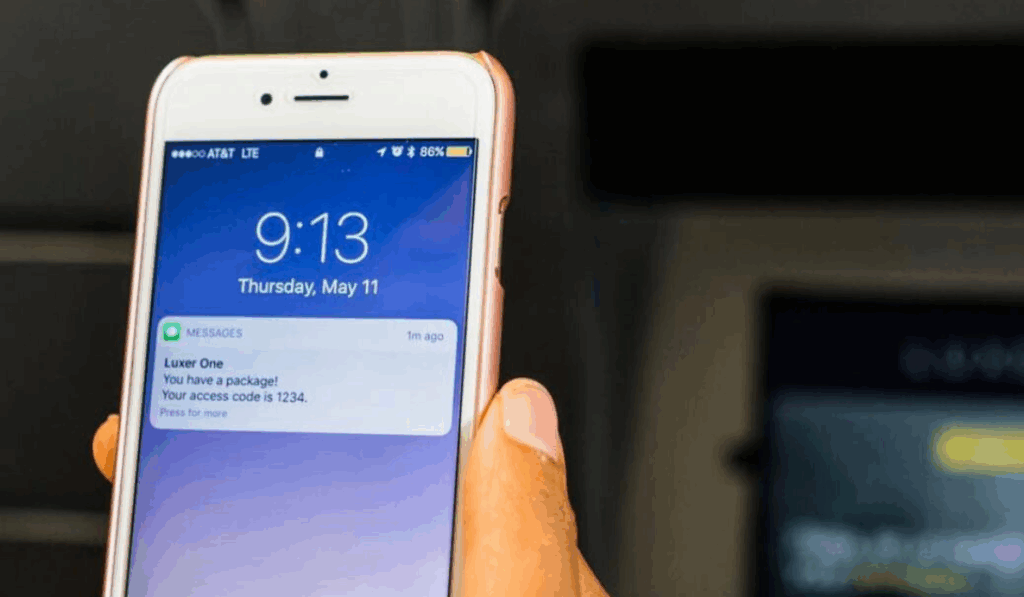

Smart package lockers automate the intake and pickup process, removing nearly all staff involvement. Deliveries are securely scanned into the system, residents receive an automatic pickup notification, and carriers complete the drop-off in seconds.

Automation delivers several measurable benefits:

- Reduced labor hours and frees onsite teams to focus on leasing and resident services.

- Fewer bottlenecks, especially during peak delivery periods.

- Improved accuracy and fewer misplaced or delayed packages.

- Increased security which can reduce theft and loss. Even the improvement to security with smart lockers alone represents a tangible return for many communities.

When comparing the labor savings against the initial system cost and any ongoing service or software fees, many communities achieve a full return on investment during their first operational year.

What About Long-Term ROI?

Because package volume continues to grow year over year, the ROI through the first 5 years is often even stronger than the first-year payoff with continued growth.

A community saving $78,000 annually in labor recovers several times the cost of the locker system across a standard five-year horizon. Those savings compound when factoring in resident satisfaction, staff efficiency, security improvements, and sustainability benefits.

Many owners also evaluate the NOI lift created when amenities improve retention and support higher renewal rates as a secondary but meaningful ROI factor.

Can Smart Lockers Generate Revenue Too?

Yes. Although ROI does not require additional revenue streams, communities often accelerate payback through usage fees and premium delivery services. Property plans (such as Level Up from Luxer One) can support amenity monetization by offering convenience-based options that residents willingly pay for.

For a deeper look at how communities create incremental returns, see this overview of new revenue streams for multifamily communities.

Revenue is not the main lever of ROI, but it can meaningfully shorten the payback period.

What Should Owners Evaluate Before Investing in Smart Lockers?

Owners evaluating the ROI of smart lockers should consider:

- Package volume and resident demographics

- Labor allocation and how much time staff spends on package tasks

- System capacity today and five years from now

- Security features, which directly impact loss prevention and risk

- Integration with smart package rooms, if hybrid solutions are needed

- Long-term durability and vendor reliability

For a deeper dive into planning and sizing a system, owners can access the Guide to Package Management download.

Conclusion: Smart Lockers Deliver Clear, Measurable ROI

When calculating the ROI on smart lockers, most apartment owners discover that automation replaces thousands of hours of annual labor. Additionally these systems strengthen operational efficiency, reduce risk, and enhance the resident experience.

In many cases, communities achieve a return within the first year and significantly more across a five-year horizon. If you want a customized ROI analysis for your property or portfolio, contact Luxer One to get started.

-

Christina Draper, Marketing Content Manager at Luxer One, creates storytelling-driven content that connects with property management professionals and highlights innovations in multifamily package management. With a marketing background from UNC Charlotte, she develops cross-channel campaigns that showcase how Luxer One is redefining the resident experience.

See Posts